31 January 2024

We meaningfully outperformed the market last year – our greatest achievement to date given how difficult that proved to be in the first “stock picker’s market” seen in a long time. As much as we enjoy sharing our insights, we are a small operation; insights are the last priority of work.

That said, we don’t want to repeat last year in which waiting for a good time to work on our insight publications ended up with no such time. We had intended to publish a list of some predictions for the new year around the holidays. Since we’ve already seen movement with one, we thought we should at least mention our top two:

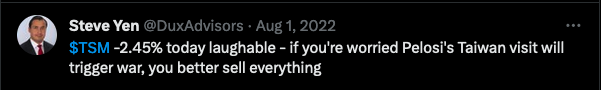

1. TSMC (TSM) – Many consider an invasion of Taiwan a serious risk to TSMC, the most important semiconductor company in the world. As we posted when Nancy Pelosi, then U.S. Speaker of the House, visited Taiwan (something we supported):

It’s irrational to sell TSMC shares for this reason or to consider a military conflict over Taiwan a tail risk to the stock. Taiwan risk couldn’t be any less idiosyncratic. If a Taiwan conflict occurs, it’s not just going to impact certain shares.

Citadel’s Ken Griffin expressed the same essential view on Taiwan during a recent interview. We believe the 8-10% GDP drawdown he mentioned – or even the term ‘great depression’ that he also used – are likely severe underestimates of the consequences if the West lost Taiwan.

Mr. Griffin and others have spoken about semiconductors, key to the matter, but perhaps they have neglected to include in their calculations that Taiwan is also the superlative global manufacturer of fasteners (screws, bolts, etc.). This is another entire category of small, precisely manufactured, and ultra-critical to the global economy material. If the West can’t get semiconductors or fasteners, it won’t be able to build the machines needed to make its own semiconductors or fasteners. In fact, the West wouldn’t be able to build or even maintain anything remotely modern without fasteners.

Thus, it’s more like check mate – game over – than an 8-10% GDP loss and a great depression. We don’t see U.S. military policy allowing that happen in the next 1-3 years, anyway, and that timeframe is currently what should be considered “long term” in the stock market. Given that has weighed on the share price of this amazing company for recent memory, we think greed and AI FOMO likely overtake caution with regard to TSMC.

2. Joe Manchin 2024 – if Joe Manchin runs for President, possibly as the democrat but preferably as a third party candidate, he would garner support from both sides of the political aisle. He could also collect republican donors given the presumed candidates at the time of publication. His candidacy would offer voters from both sides a more palatable option than either of the leading two-party system candidates and we believe that voter appetite for a third party is greater than even.

Disclosure: We are long TSM. This is an opinion article not intended as investment advice. Any opinions expressed are as of the date of publication.